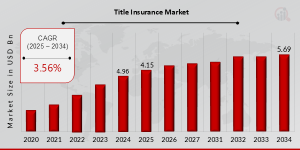

Title Insurance Market to Reach USD 5.69 Billion by 2034 | Expected CAGR 3.56% (2025–2034)

Title Insurance Market Research Report By, Type of Title Insurance, Application, Distribution Channel, Policy Type, Regional

OR, UNITED STATES, August 18, 2025 /EINPresswire.com/ -- The global Title Insurance Market has maintained steady growth and is expected to expand moderately over the coming decade. In 2024, the market size was estimated at USD 4.96 billion and is projected to grow from USD 4.15 billion in 2025 to an impressive USD 5.69 billion by 2034, reflecting a compound annual growth rate (CAGR) of 3.56% during the forecast period (2025–2034). The growth is primarily driven by increasing real estate transactions, rising demand for property title protection, and evolving regulatory frameworks across key markets.Key Drivers Of Market Growth

Increasing Real Estate Transactions- The growth of residential and commercial real estate markets is fueling demand for title insurance. Buyers and lenders seek protection against potential title defects, liens, or legal disputes.

Rising Demand for Property Title Protection- Property owners and financial institutions increasingly recognize the importance of mitigating legal and financial risks associated with property ownership. Title insurance provides financial security and peace of mind.

Regulatory Compliance and Risk Mitigation- Government policies and real estate regulations in various regions are encouraging or mandating title insurance to protect both lenders and property buyers.

Technological Advancements in Title Services- Digitalization of title searches, e-recording, and blockchain-based solutions are streamlining processes, improving accuracy, and enhancing customer experience in the title insurance industry.

Get a FREE Sample Report – https://www.marketresearchfuture.com/sample_request/33855

Key Companies in the Title Insurance Market Include

• Fidelity National Financial, Inc.

• First American Financial Corporation

• Old Republic International Corporation

• Stewart Information Services Corporation

• Chicago Title Insurance Company

• Title Resources Guaranty Company

• Westcor Land Title Insurance Company

• North American Title Insurance Company

• ProTecht, Inc.

• Alliant National Title Insurance Company

• FNF Title Group

• AmTrust Title Insurance Company

• Amrock, LLC

• HomeServices Title, among others

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/title-insurance-market-33855

Market Segmentation

To provide a comprehensive analysis, the Title Insurance market is segmented based on type, application, and region.

1. By Type

• Lender’s Title Insurance: Protects mortgage lenders from title-related risks.

• Owner’s Title Insurance: Protects property owners against title defects and legal claims.

2. By Application

• Residential: Coverage for homebuyers and residential property transactions.

• Commercial: Protection for commercial property transactions, including offices, retail, and industrial assets.

3. By Region

• North America: Dominates the market due to mature real estate markets and regulatory requirements.

• Europe: Growth driven by increasing property transactions and regulatory support.

• Asia-Pacific: Emerging market with rising real estate development and increasing awareness of title insurance.

• Rest of the World (RoW): Gradual adoption in Latin America, the Middle East, and Africa due to expanding real estate sectors.

Purchase Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=33855

The global Title Insurance market is poised for steady growth, driven by increasing property transactions, regulatory compliance, and risk mitigation requirements. As real estate markets continue to expand and property ownership complexities rise, title insurance will remain an essential component of secure property investment strategies through 2034.

Top Trending Research Report :

Commercial Insurance Market - https://www.marketresearchfuture.com/reports/commercial-insurance-market-23980

Credit Insurance Market - https://www.marketresearchfuture.com/reports/credit-insurance-market-24055

Crime Insurance Market - https://www.marketresearchfuture.com/reports/crime-insurance-market-23993

Crop Insurance Market - https://www.marketresearchfuture.com/reports/crop-insurance-market-24059

Decentralized Insurance Market - https://www.marketresearchfuture.com/reports/decentralized-insurance-market-24081

Disability Insurance Market - https://www.marketresearchfuture.com/reports/disability-insurance-market-24114

Electronic Gadget Insurance Market - https://www.marketresearchfuture.com/reports/electronic-gadget-insurance-market-24132

Embedded Insurance Market - https://www.marketresearchfuture.com/reports/embedded-insurance-market-24048

Engineering Insurance Market - https://www.marketresearchfuture.com/reports/engineering-insurance-market-24104

Entertainment Insurance Market - https://www.marketresearchfuture.com/reports/entertainment-insurance-market-24116

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.